Ordinary Least Squares (OLS)¶

Ordinary Least Squares (OLS) 선형 회귀분석을 수행합니다.

Syntax

OrdinaryLeastSquares (SimpleFeatureCollection inputFeatures, String dependentVariable, String explanatoryVariables) : SimpleFeatureCollection, SpatialOLSResult

Input Parameters

Identifier |

Description |

Type |

Default |

Required |

inputFeatures |

종속변수와 독립변수를 포함하고 있는 입력 레이어입니다. |

SimpleFeatureCollection |

✓ |

|

dependentVariable |

종속변수값을 가진 숫자 필드입니다. |

String |

✓ |

|

explanatoryVariables |

회귀 분석에 사용할 쉼표로 구분된 설명 변수 숫자 필드의 목록입니다. |

String |

✓ |

Process Outputs

Identifier |

Description |

Type |

Default |

Required |

olsFeatures |

종속 변수 추정치와 잔차를 포함한 출력 레이어입니다. |

SimpleFeatureCollection |

||

report |

OLS 분석 결과입니다. |

SpatialOLSResult |

✓ |

Constraints

olsFeatures 레이어는 inputFeatures의 모든 필드를 포함해서 Estimated, Residual, StdResid, StdResid2 필드가 추가된다.

report 결과는 XML로 반환된다.

Examples

a1_2000 필드를 종속변수로, a2_2000, a3_2000, a4_2000 필드를 설명변수로 분석한 결과는 다음의 XML 포맷으로 반환됩니다.

<?xml version="1.0" encoding="UTF-8"?>

<OrdinaryLeastSquares>

<ModelName>Ordinary Least Squares(OLS) Regression</ModelName>

<Dataset>seoul_series</Dataset>

<DependentVariable>a1_2000</DependentVariable>

<NumberOfObservations>25</NumberOfObservations>

<NumberOfVariables>4</NumberOfVariables>

<DegreesOfFreedom>21</DegreesOfFreedom>

<MeanDependentVar>18229.716524000003</MeanDependentVar>

<SdDependentVar>5222.973372203831</SdDependentVar>

<RSquared>0.2524024367985146</RSquared>

<AdjustedRSquared>0.14560278491258805</AdjustedRSquared>

<SumSquaredResidual>4.8945722348412424E8</SumSquaredResidual>

<SigmaSquare>2.3307486832577344E7</SigmaSquare>

<SeOfRegression>4827.782807104866</SeOfRegression>

<SigmaSquareML>1.957828893936497E7</SigmaSquareML>

<SeOfRegressionML>4424.736030472888</SeOfRegressionML>

<FStatistic>2.363326399800135</FStatistic>

<PValue>0.10015684828181148</PValue>

<LogLikelihood>-245.3476108684226</LogLikelihood>

<AIC>498.6952217368452</AIC>

<AICc>503.8531164736873</AICc>

<SchwarzCriterion>503.57072503631804</SchwarzCriterion>

<Summary>

<Variable>

<Variable>CONSTANT</Variable>

<Coefficient>-89839.01661165891</Coefficient>

<StandardError>45251.64301979817</StandardError>

<TStatistic>-1.9853205456507557</TStatistic>

<Probability>0.060320415845298396</Probability>

</Variable>

<Variable>

<Variable>a2_2000</Variable>

<Coefficient>1015.5016202521613</Coefficient>

<StandardError>459.27386712849943</StandardError>

<TStatistic>2.2111025532572612</TStatistic>

<Probability>0.03825397847242593</Probability>

</Variable>

<Variable>

<Variable>a3_2000</Variable>

<Coefficient>657.585445515956</Coefficient>

<StandardError>687.1537990129104</StandardError>

<TStatistic>0.9569698173255696</TStatistic>

<Probability>0.3494719862156815</Probability>

</Variable>

<Variable>

<Variable>a4_2000</Variable>

<Coefficient>74.91087027691356</Coefficient>

<StandardError>575.0254410828144</StandardError>

<TStatistic>0.13027401037396014</TStatistic>

<Probability>0.8975891001920921</Probability>

</Variable>

</Summary>

<VarianceInflationFactor>

<VIF>

<Variable>a2_2000</Variable>

<Value>1.0512492909076563</Value>

</VIF>

<VIF>

<Variable>a3_2000</Variable>

<Value>1.219785000060916</Value>

</VIF>

<VIF>

<Variable>a4_2000</Variable>

<Value>1.178277144719415</Value>

</VIF>

</VarianceInflationFactor>

<Multicollinearity>124.00930330161376</Multicollinearity>

<NormOfErrors>

<Diagnostics>

<Category>Test on Normality of Errors</Category>

<Name>Jarque-Bera</Name>

<DeegreesOfFreedom>2.0</DeegreesOfFreedom>

<Value>0.7273519517018467</Value>

<Probability>0.6951163927538146</Probability>

</Diagnostics>

</NormOfErrors>

<HrcDiagnostics>

<Diagnostics>

<Category>Diagnostics for Heteroskedasticity Random Coefficients</Category>

<Name>Breusch-Pagan</Name>

<DeegreesOfFreedom>3.0</DeegreesOfFreedom>

<Value>5.083212261808894</Value>

<Probability>0.16580435989410658</Probability>

</Diagnostics>

<Diagnostics>

<Category>Diagnostics for Heteroskedasticity Random Coefficients</Category>

<Name>Koenker-Bassett</Name>

<DeegreesOfFreedom>3.0</DeegreesOfFreedom>

<Value>6.588607922676707</Value>

<Probability>0.08623276842110539</Probability>

</Diagnostics>

</HrcDiagnostics>

</OrdinaryLeastSquares>

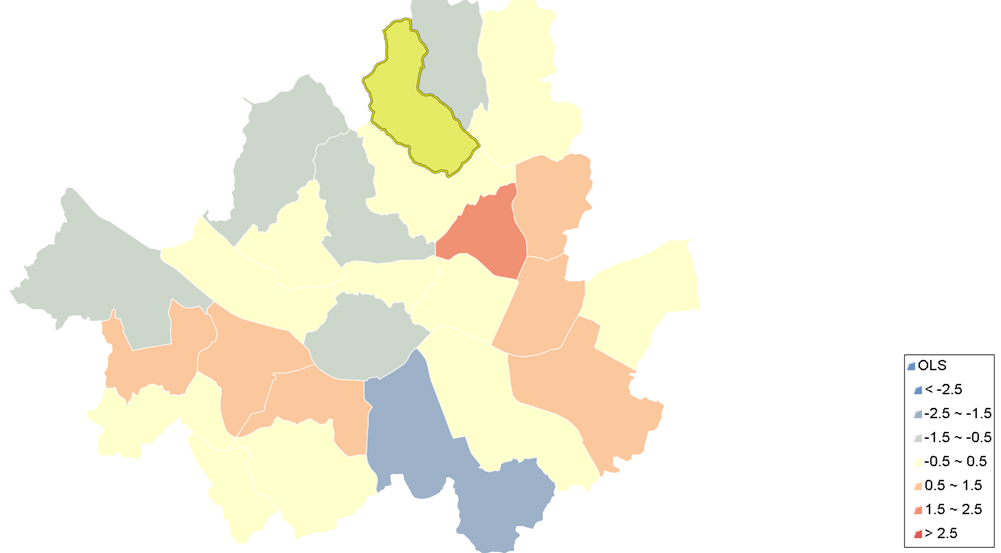

잔차를 이용한 시각화 결과입니다.